How to check custom duty in Ghana online

You can check custom duty in Ghana by using the ICUMS website. You will need to provide the weight and value of the item in order to get the estimated tax and duty fees.

Know your tax and duty fees when shipping from anywhere in the world to Ghana based on your shipment weight, value, and product type.

If you are importing a vehicle, You will need to provide the, Chassis number or Vehicle Identification Number (VIN), Model, Year, and Make. If you have an interest in importing items to Ghana, Knowing how to calculate your duty and tax charges will help you tremendously. Ghana import duty is assessed based on the volume, weight, or value of an item, and is subject to change every year. Import duty rates range from 0%, 5%, 10%, and 20%, and the fees are collected by the Ghana Customs Division.

New Tax Policies And Amendments In Ghana 2021

What is Customs Duty?

Customs is an authority in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country.

What is ICUMS?

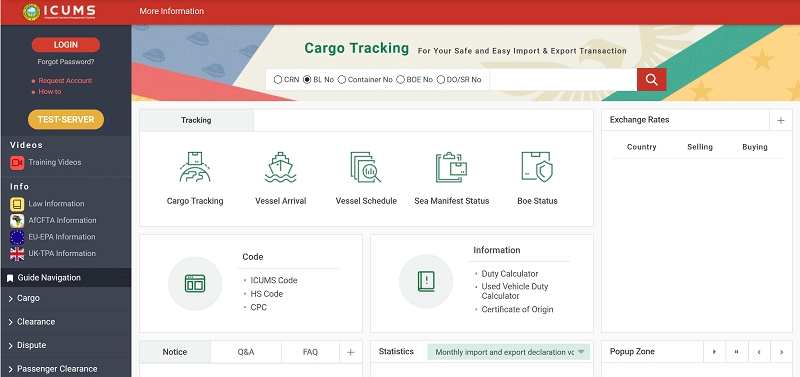

ICUMS is an online Customs management system that provides swift customs clearance and helps users track goods as well as calculate importation costs and duties.

Some of its features include:

- Cargo Tracking

- Vessel Arrival

- Vessel Schedule

- Sea Manifest Status

- Boe Status

How to check customs duty in Ghana online. Visit the official ICUMS website.