How To Fund Payoneer Account

Payoneer is an online payment platform that allows individuals and businesses to send and receive payments in various currencies. It is a popular choice for freelancers, affiliate marketers, and small businesses that need to receive payments from international clients or companies.

With Payoneer, you can receive payments from a wide range of companies, such as Amazon, Fiverr, Ebay, Upwork, Taboola, Crossover, Google, and Airbnb, directly to your Payoneer account. You can also use the platform to make payments to other Payoneer users, as well as withdraw funds to your bank account or make online purchases.

Payoneer also offers a Mastercard debit card that can be used to withdraw cash from ATMs or make purchases online or in-store, anywhere Mastercard is accepted.

Payoneer is available in more than 200 countries and supports multiple currencies, including USD, EUR, GBP, JPY, and more. However, some features such as funding options and fees may vary depending on the country of residence and the currency of the account. It’s important to review the terms and conditions and fees before signing up for an account.

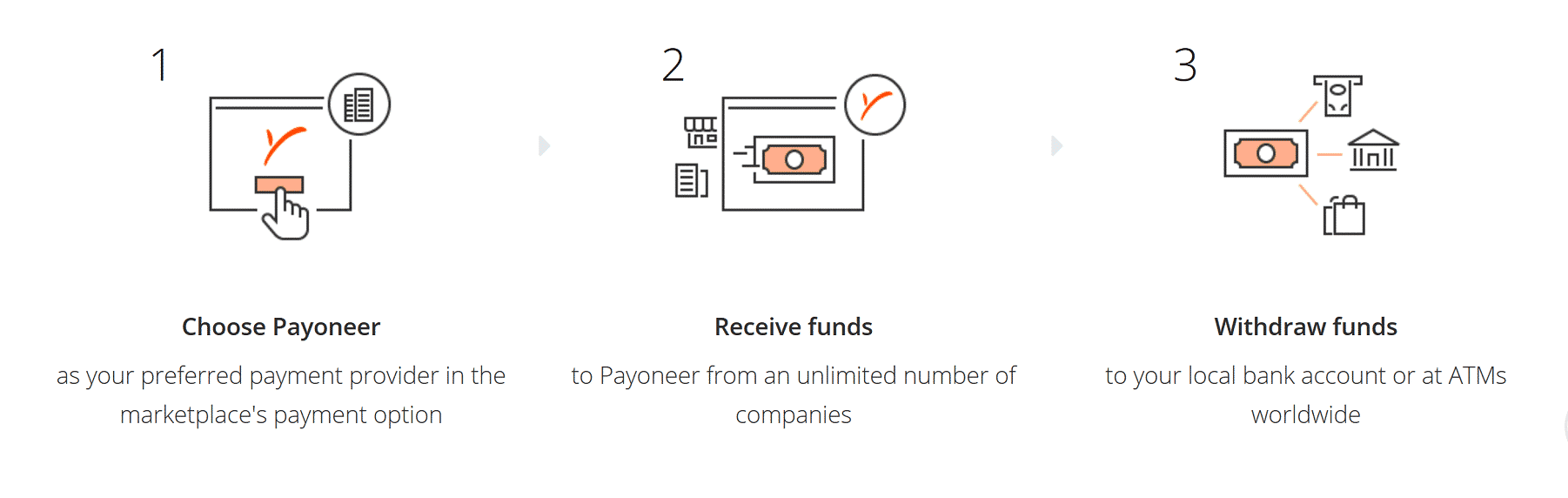

How to Receive Payments with Payoneer

To receive payments with Payoneer, you will need to sign up for a Payoneer account and link it to the platforms or businesses that you want to receive payments from. Here are the steps to do so:

- Sign up for a Payoneer account: Go to the Payoneer website and sign up for an account. You will need to provide some basic information, such as your name, address, and contact information.

- Link your Payoneer account to the platform or business: Once you have a Payoneer account, you can link it to the platforms or businesses that you want to receive payments from. This can typically be done by going to the settings or payment options on the platform or business and providing your Payoneer account information.

- Provide your Payoneer account information to the sender: If you are receiving payments from someone directly, you will need to provide them with your Payoneer account information, such as your email address and account number.

- Wait for the payment to be credited to your account: Once the sender initiates the payment, it will be credited to your Payoneer account within 2-5 business days.

It’s important to note that the availability of receiving payments options may vary depending on the platform or business, also, fees may apply depending on the payment method, currency, and location.

Funding Your Payoneer Account

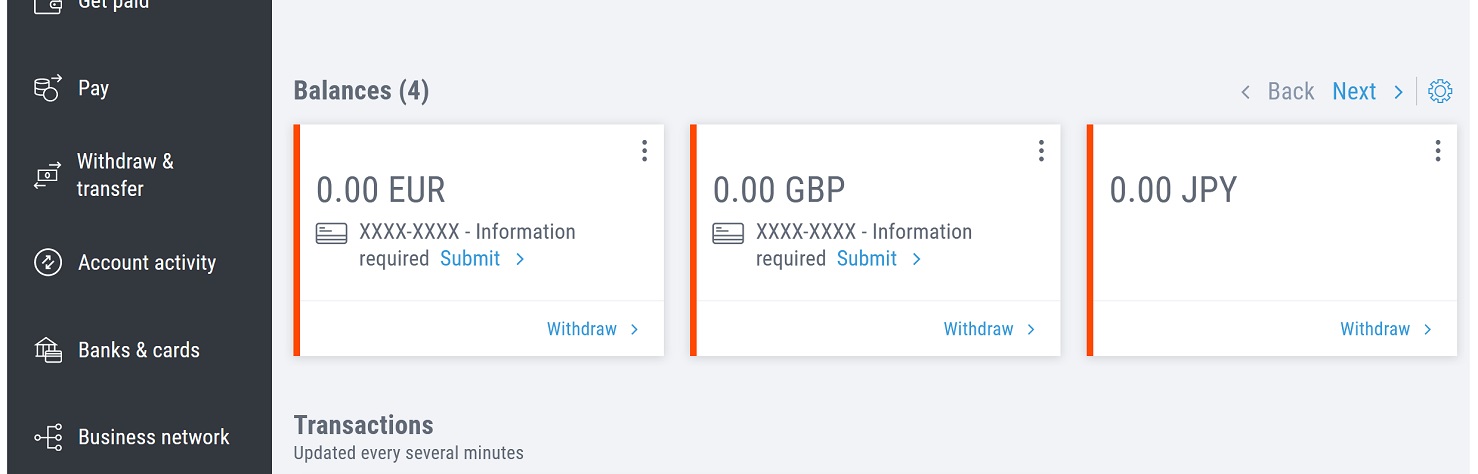

There are several ways to fund your Payoneer account:

- Bank transfer: You can link your Payoneer account to your bank account and make a direct deposit to your Payoneer account.

- Credit or debit card: You can use a credit or debit card to make a deposit to your Payoneer account.

- PayPal: You are unable to fund your Payoneer account from Paypal and other e-wallets.

- Local Payment providers: You can use local payment providers such as cash deposits, mobile money, and online bank transfers to fund your Payoneer account.

- Transfer from other Payoneer account: You can receive money from other Payoneer account holders.

It’s important to note that the availability of these funding options may vary depending on your location and the currency of your Payoneer account. And also, the fees for funding your Payoneer account may vary depending on the funding method you choose and the currency of your account.

How to fund Payoneer account with Bank transfer

To fund your Payoneer account using a bank transfer, you will need to link your Payoneer account to your bank account. Here are the steps to do so:

- Log in to your Payoneer account.

- Go to the “Add Funds” tab.

- Select “Bank Transfer” as the funding method.

- Enter the amount you wish to transfer and select the currency of your account.

- Review the details and confirm the transaction.

- Payoneer will provide you with the necessary bank account details to make the transfer. You will need to use these details to make the transfer from your bank account to your Payoneer account.

- Once the transfer is complete, the funds will be credited to your Payoneer account within 2-5 business days.

It’s important to note that bank transfer funding options may vary depending on your location and the currency of your Payoneer account. Also, bank transfers may incur additional fees, it’s important to check with your bank for any additional fees and to confirm that the transaction is completed successfully.

UK Receiving Account Funding Guidlines

- Use for local bank transfers within the UK in GBP via the BACS or Faster Payments Service network

- Only payments for business transactions from business accounts are supported

- Payments from personal bank accounts will be declined

- Payments made from a bank account in your name will be declined

- Wire transfers are not supported

Read also: How to Create a Payoneer Account in Ghana and Nigeria

US Receiving Account Funding Guidelines

- Use for local bank transfers within the US in USD via the ACH network

- Only payments for business transactions from business accounts are supported

- Payments from personal bank accounts will be declined

- Payments made from a bank account in your name will be declined

- Wire transfers are not supported

What is an ACH Transfer?

An ACH transfer is a digital transfer between bank accounts. It moves funds from one bank account to another. After money has been deducted from an account, it is transferred to a clearing house. The ACH(Automated Clearing house) network serves as an intermediary between the two banks and then to the recipient’s account. It is free and easy and is more secure than other payment methods. ACH transfers can take a few days to process.

ACH transfers are typically processed by banks. Because they are processed by banks, the transfer may take a few business days to reflect in the recipient’s account. This is why it is a better option for businesses that are high risk.

ACH transfers are often cheaper than wire transfers. Most banks charge between $14 and $75 for outbound ACH transfers. Although wire transfers are more reliable, they can be slow to clear and can take a few days. ACH payments are much faster than wire transfers. The difference in costs is often enough to make ACH payments the most cost-effective option. If you can’t afford a wire transfer, ACH is a good alternative.

Because ACH is handled by banks, it takes time to clear. Because the ACH network is only active during business hours, an ACH transfer made on a weekend may not reflect in the recipient’s account until the following week. However, if you need your money right away, you can choose a same-day payment. This is because ACH payments are settled in two batches each day. This ensures that your money is deposited on the same day.

ACH transfers are inexpensive and can be used for small amounts. While they may seem expensive at first, they are a great alternative to wire transfers. ACH transfers are the most affordable way to move money, and the cost of ACH transactions can be as low as $0.29 per transaction.

ACH Transfer Meaning

ACH also known as Automated Clearing House, is an electronic placement of money from one bank account to another. It is also used to make payments between accounts. ACH payments can be used for bill payments, government benefit payments, and business-to-business transactions. The ACH network is governed by the National Automated Clearing House Association, which requires strict compliance with transaction protocols. If you miss the necessary instructions, the transaction will fail. If the payment fails to clear, it will be declined.

ACH transfers are the best option when money isn’t needed to be transferred instantly. For example, payroll, automatic bill pay, and other similar situations can use ACH transfers. An ACH is free and generally requires a bank account. Besides paying fees, an ACH can be used to transfer money from one account to another. You can also use it to send money to other people and organizations. This service is free and works with almost any bank.

ACH transfers are free for consumers. It costs businesses to use the network to send money to other businesses. While ACH is free for consumers, it can be expensive for businesses. You’ll pay for the ACH network service when you use it to fund your payment. But ACH transfers are the best option for many businesses. You can make these payments online depending on the bank you’re using. In addition, you can send money to your family and friends.

Although ACH transfers are free for consumers, they are not free for businesses. A small fee is usually charged for the service. The fees vary from bank to bank. Some banks will charge a flat fee for sending money to another location, while others will charge a variable fee. Aside from these fees, ACH payments are cheaper than EFT. If you’re sending money to a business, consider using an ACH transfer.

Summary

An ACH transfer is a digital transfer of funds from one bank account to another.

It is free and simple to use, as well as more secure than other payment methods.

Because ACH transfers can take several days to process, they are typically used for small amounts. ACH processing has a median internal cost of $0.29 per transaction. An ACH transfer is a method of electronically transferring funds from one bank account to another.

It can be used to pay bills, receive government benefits, and conduct business-to-business transactions.While ACH transfers are free for individuals, they can be costly for businesses.