MTN Qwikloan: How to get MTN Quick loans in Ghana

Getting quick loans in Ghana has become easier. You can get an instant loan without going to the bank or joining long queues. In this article, we’ll show you how to get MTN quick loans in seconds in the comfort of your home. You can get up to 5,000 GH cedis loan from MTN instantly.

MTN is the largest Telecommunications company in Ghana. The company currently has over 19.83 million subscribers and offers a wide range of products and services which includes quick loans.

What are Quick loans?

Quick loans are loans provided to customers instantly without requesting for too much verification or documentation from the borrower. These type of loans are often provided within few hours or minutes of application.

MTN Ghana Quick Loans

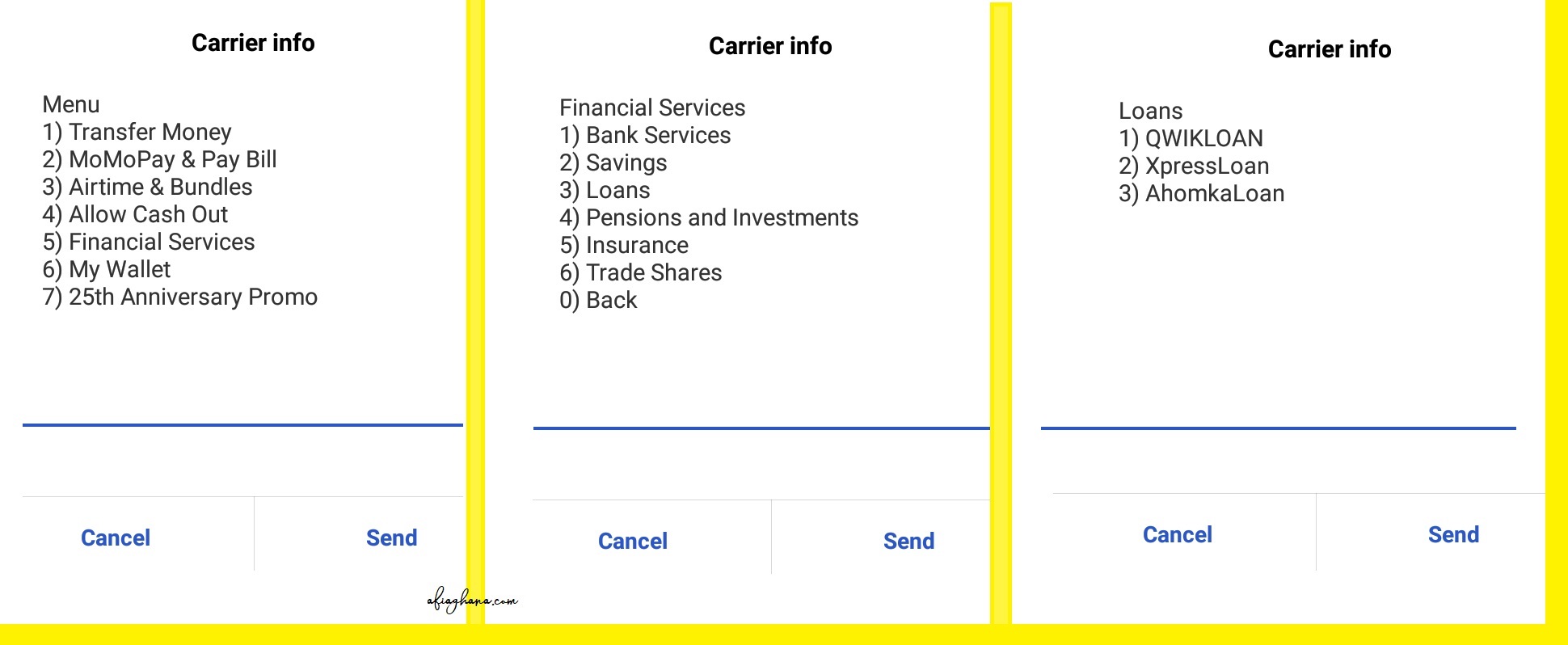

MTN Ghana currently offers three(3) quick loan services in Ghana which are; Qwikloan, AhomkaLoan, and XpressLoan.

Qwikloan

MTN QWIKLOAN is a short-term cash loan given to MTN users and disbursed to your MTN mobile money wallet within 3 minutes after applying…You are not required to provide collateral or any supporting documents to get the loan. The maximum amount is GHS2500

AhomkaLoan

MTN Ahomkaloan is a quick loan given by MTN with an interest rate of 6.9% and 12.5% if the applicant fails to pay on time. The maximum amount is GHS1000.

XpressLoan

XpressLoan is offered to selected MTN users without providing collateral or visiting a bank. The maximum amount of loan limit is GHS1000.

Mtn Ghana Quick Loans Requirement

You will have to meet the requirements below in order to get approved for a loan:

- Applicant must be 18years and above

- Applicant should be a frequent Mobile money user

- Applicant must be an MTN sim user for more than 120 days

- Applicant should have a MOMO transaction history of over GHS2000

How to register for Mtn Qwik Loan

QwikLoan partnered with AFB Ghana and MTN MoMo provides registered MTN users with an innovative financial solution that provides quick and convenient loans.

This loan is a short-term, unsecured, cash loan paid into your MTN Mobile Money wallet. The loan is simple and accessible, with no previous savings required. If you pay your loan on time, every time, you will continue to have access to a loan whenever you need it, instantly.

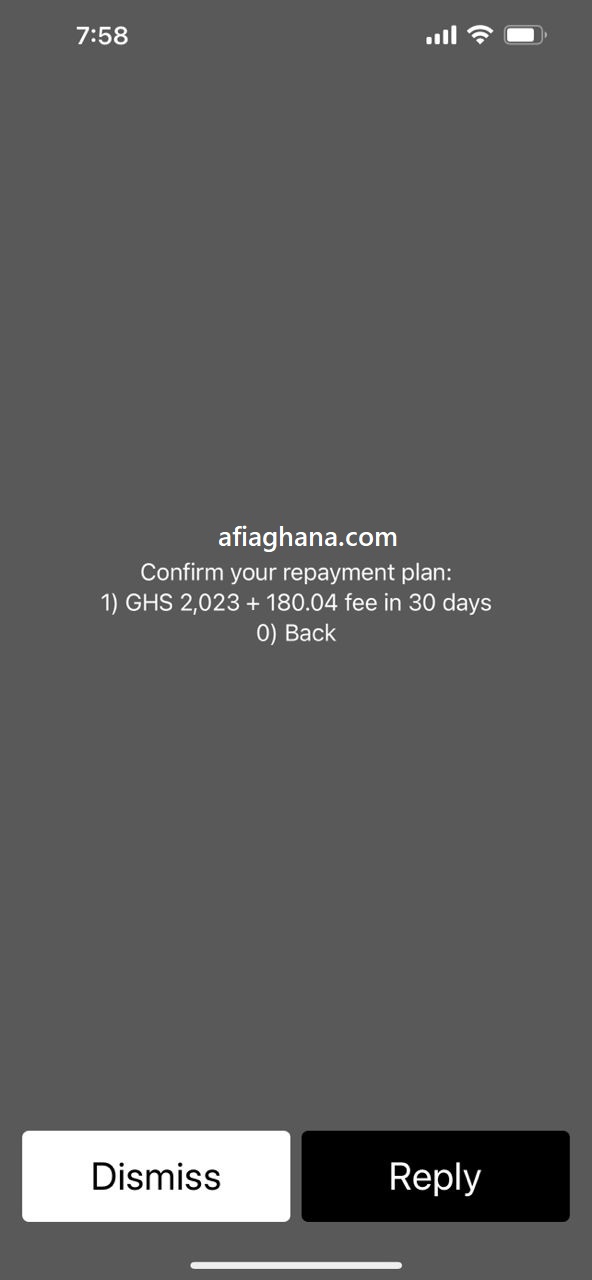

Steps to follow:

- Dial *170#

- Select option 5 -financial services

- Select option 3 – loans

- Select option 1 for QwikLoan

- Select option 1 to apply for a loan

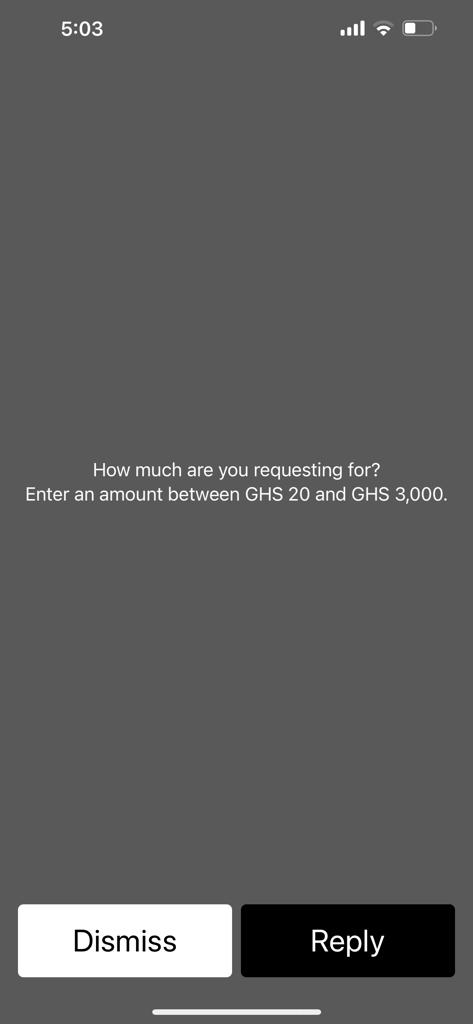

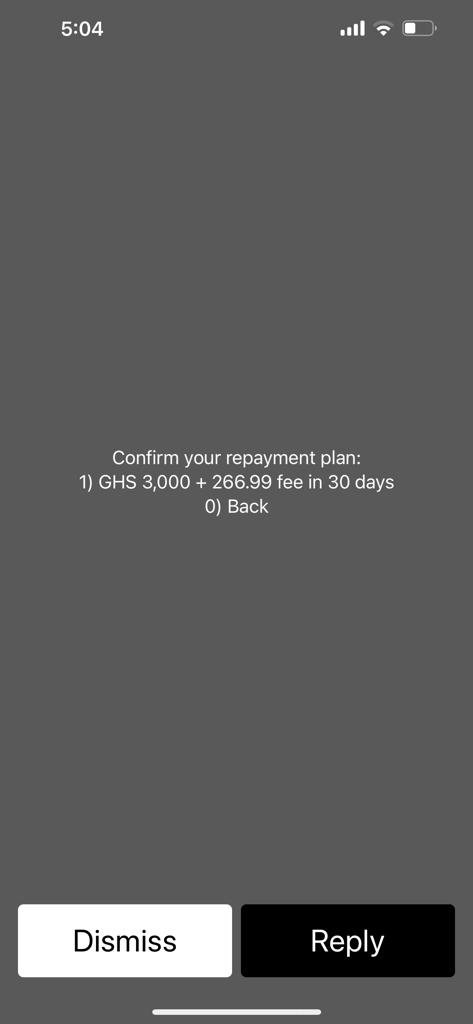

- Select the amount of loan you’ll like to borrow

- Confirm to repay your loan within the given duration

- Accept terms and conditions

- Enter your MoMo pin

- Wait for your loan to be disbursed into your Mobile money wallet

Read the MTN QwikLoan Terms and Conditions for more details.

What’s the maximum Mtn loan limit?

You can access up to a 3,500 GH Cedis loan from MTN. This loan will be given by Xpressloan with the help of Ecobank. Ecobank has declared to give up to 50,000 cedis in instant loans in the future.

How to Repay your MTN QwikLoan

To qualify for another loan, you’ll must repay your previous loan. Follow the steps below to repay your MTN QwikLoan.

- Dial *170#

- Select option 5 – financial services

- Select option 3 – loans

- Select option 1 – QwikLoan

- Select option 2 – Repay a loan

- Enter your MoMo Pin

- Select to repay the full amount

- The money will be deducted from your Mobile money wallet

How to apply for MTN Ahomka Loan

- Dial *170#

- Select option 5 – financial services

- Select option 3 – loans

- Select option 3 – AhomkaLoan

- Select option 1 – Get a loan

- Enter your MoMo Pin

- Enter option 1 – view offers

- Select your amount (Minimum amount is 40cedis)

- Select option 1 to confirm to repay your loan within the given duration

- Wait for your loan to be disbursed into your Mobile money wallet

How to Repay MTN AhomkaLoan

To qualify for another loan, you’ll must repay your previous loan. Follow the steps below to repay your MTN Ahomkaloan.

- Dial *170#

- Select option 5 – financial services

- Select option 3 – loans

- Select option 3 – AhomkaLoan

- Select option 2 – Repay a loan

- Enter your MoMo Pin

- Select to repay the full amount

- The money will be deducted from your Mobile money wallet

How to apply for MTN XpressLoan

- Dial *170#

- Select option 5 – financial services

- Select option 3 – loans

- Select option 2 – xpressLoan

- Select option 1 – Get a loan

- Enter your MoMo Pin

- Enter option 1 – view offers

- Select your amount (Minimum amount is 40 cedis)

- Select option 1 to confirm to repay your loan within the given duration

- Wait for your loan to be disbursed into your Mobile money wallet

How to Repay MTN XpressLoan

To qualify for another loan, you’ll must repay your previous loan. Follow the steps below to repay your MTN Xpressloan.

- Dial *170#

- Select option 5 – financial services

- Select option 3 – loans

- Select option 2 – XpressLoan

- Select option 2 – Repay a loan

- Enter your MoMo Pin

- Select to repay the full amount

- The money will be deducted from your Mobile money wallet

What happens if I don’t pay my MTN loan on time?

Failure to pay your MTN loans on time will result in a 12.5% late fee charge.

Qualify for MTN QwikLoan: Tips and Tricks for Fast Approval

If you are interested in getting a loan from MTN But can’t seem to qualify for any of the loan services; Qwikloan, Xpressloan, or Ahomkaloan, this information will give you the necessary steps you have to take to get a quick loan in no time.

The first and most important step is to get a registered MTN sim card with your credentials. Your sim should be registered with your real name and a genuine Government-issued Identity card (Passport, drivers license, Voters ID, or Ghana card).

In case you already possess a registered MTN sim and you still do not qualify for any of the loan services, what this means is, that you either aren’t using your MoMo account frequently or you barely receive payments in your Momo wallet.

Follow the tips and tricks below to get approved for MTN loans as soon as possible.

Read the MTN QwikLoan Terms and Conditions for more details.

Tips and Tricks to Qualify for an MTN loan Fast

- You should be 18years and above

- Your MTN sim card should be at least 12 – 24 months old.

- You should buy a minimum of 1000 cedis worth of Airtime during the course of 12 – 24 months

- You should make transactions of at least 5000 cedis during the 12 – 24 months period.

- You should link your Ghana bank account with your mobile money wallet.

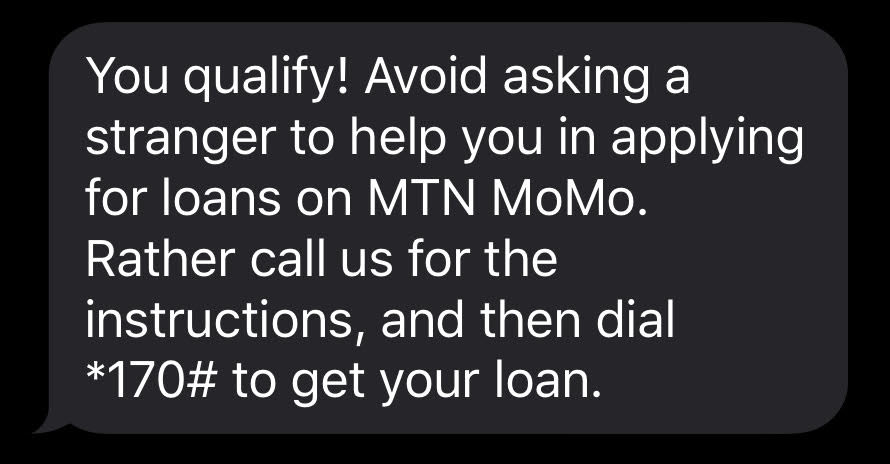

Once you’ve met all the requirements above, You should receive a message that says “You qualify! Avoid asking a stranger to help you in applying for loans on MTN MoMo. rather call us or dial *170# to get your loan”

Read also: MTN Qwikloan: How to get MTN Quick loans in Ghana

Ad: Get Receipt template online free